Demographic changes and intergenerational transfers in Portugal: state of knowledge

Introduction

The analysis of the economic evolution has been traditionally carried out separately from the demographic evolution. However, at the end of the last century, an influent work from Bloom and Williamson (1998) introduced the term "demographic dividend", referring to the interaction between the age composition of the population and the economic growth. The demographic transition that developed countries are experiencing, from societies with high

rates of birth and death to societies with high life expectancy and very low birth rates, is changing the demographic pyramids of those states. Portugal is one of the countries in Europe with the lowest fertility rate (1.36 children per woman in 2016). Like in other countries of southern Europe, this has caused an accelerated aging of its population and a rapidly growing proportion of older adults. In 1960, only 8% of the population was over 65 years old, but this

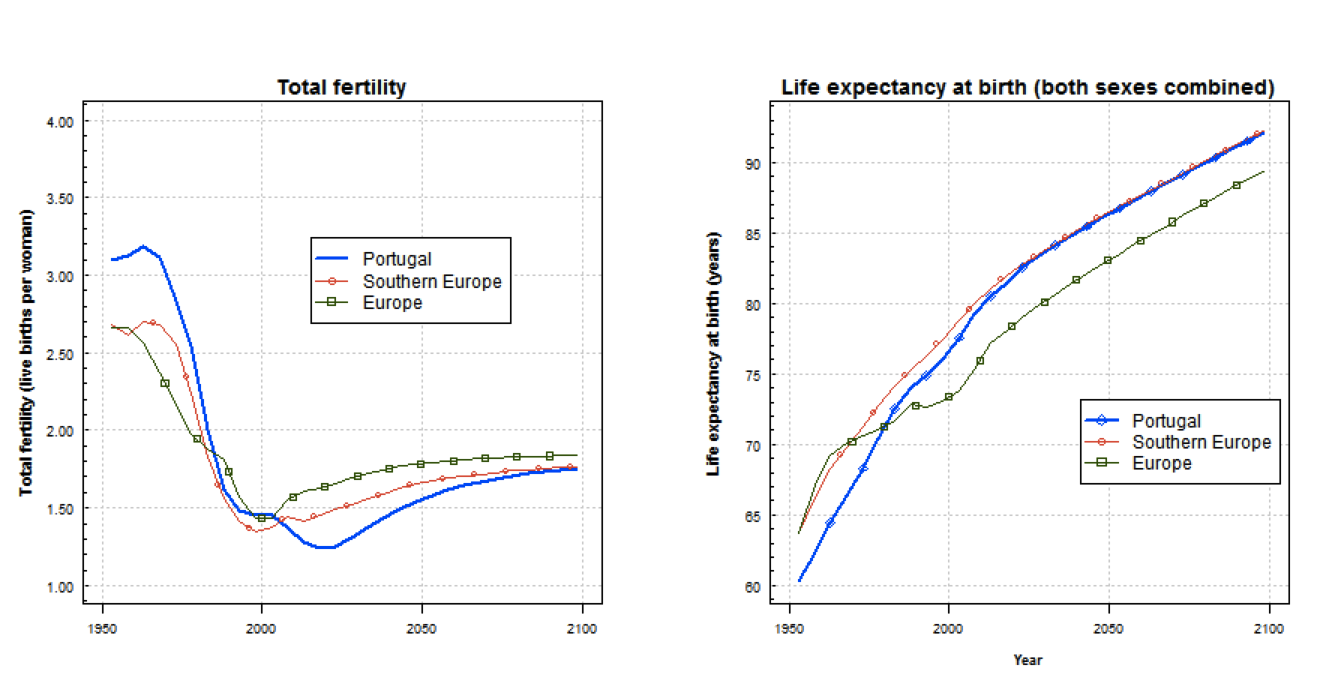

percentage has increased to more than 20% in 2016. The ageing of the population puts the welfare system in check, since it implies an increase in expenses in pensions and healthcare. Figure 1 shows the evolution since 1950 and the projections to 2100 of both variables for Portugal: the fertility rate (number of children per woman) and the average life expectancy at birth. Forecasts tell us that the fertility rate will remain at minimum rates and far from the rate of replacement of the population, while life expectancy will continue to grow and far exceed the European average. Similar results are found in the INE (Instituto Nacional de Estatística) estimation made in 2008, which forecasted that in 2060 the life expectation of birth for Portugal will be around 89 years for women and 83 for men.

Figure 1 – Fertility rate and life expectancy at birth in Portugal, 1950-2100

Source: UN Population Prospects 2018, https://population.un.org/wpp/

Source: UN Population Prospects 2018, https://population.un.org/wpp/

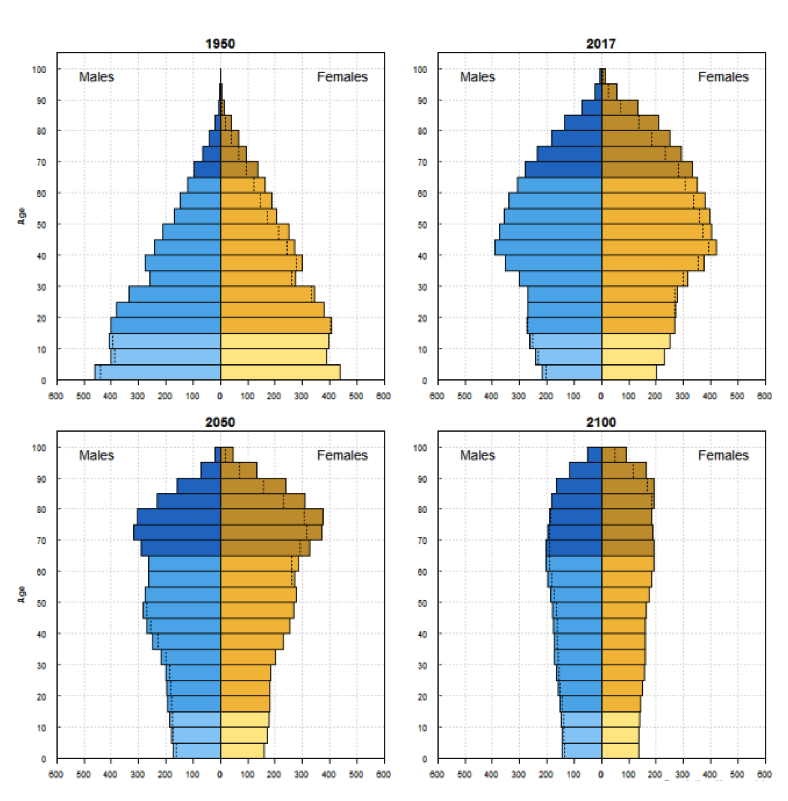

Thus, both past demographic evolution and future projections inevitably lead to a radical change in the age structure of the population. The pyramids in Figure 2 support this statement.

Figure 2 – Population pyramids in Portugal, 1950-2100

Source: UN Population Prospects 2018, https://population.un.org/wpp/

This project intends to carry out a historical analysis of how demographic evolution has interacted with economic development. In particular, our interest is to study the creation and evolution of the welfare state, and how different social policies have evolved and interacted with the role of families in intergenerational transfers. The life cycle of people implies that, while they need to always consume a basic amount of goods throughout their lives, they are able to generate the necessary resources for it only during certain ages (typically during the working age). On the contrary, in childhood and in retirement, people need some kind of financial support either from the family or from the state in order to cover their needs. In the case of the elderly, there is the theoretical possibility of resorting to intertemporal reallocations of income, meaning that people are induced to save while working and consume during old age). Nowadays, private transfers flow mainly from parents to children while public transfers flow mainly to the older population. Welfare policies have an important age component: pensions and health care are aimed primarily at the elderly, while education benefits the youngest. Therefore, a change in the population pyramids will have important effects in the financial stability of the state.

Our objective is to see how the welfare state has developed historically in Portugal, and how it has interacted with demographic change. We then draw conclusions that could be useful in order to design policies which allow us to face aging with guarantees.

Methodology: National Transfer Accounts (NTA)

The methodology to be used in our historical analysis employs the so-called National Transfers Accounts (NTA for its acronym in English). The approach was developed in the early

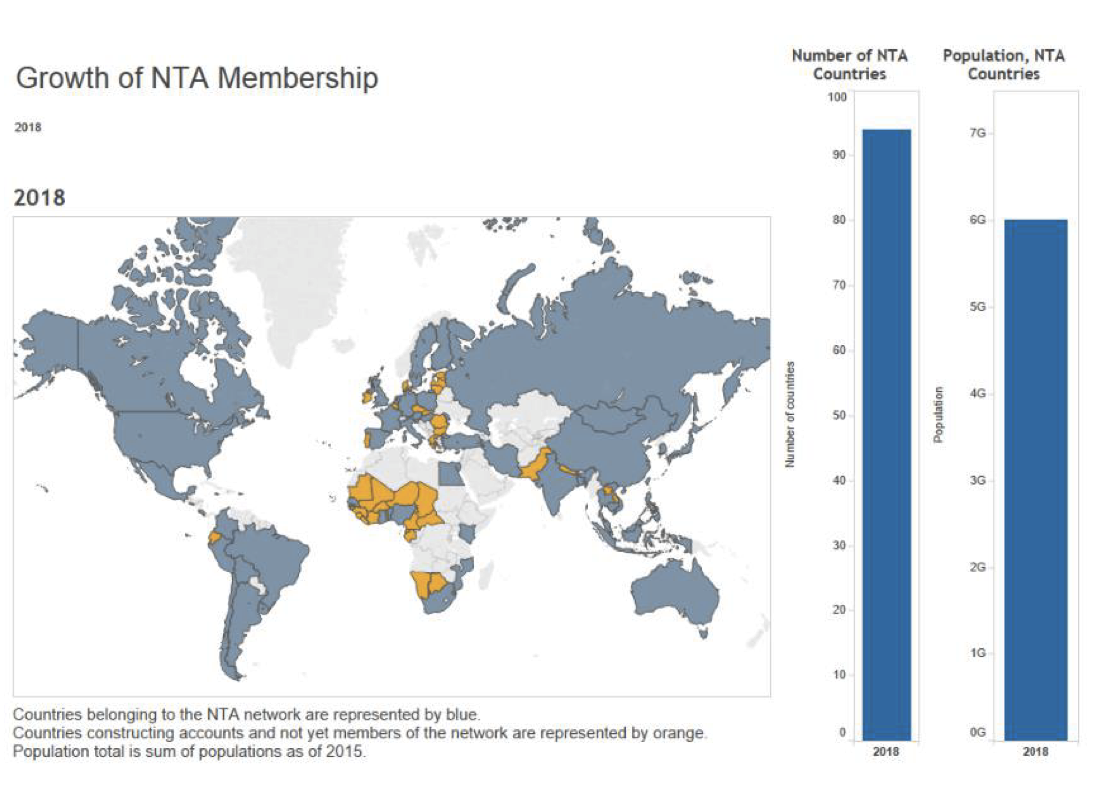

2000s following an international project led by the University of Berkeley and The University of Hawaii. Currently, more than forty countries around the world participate in this project (see Figure 3). The methodology for estimating NTAs has been approved and published in a manual by the United Nations (Population Division).

Figure 3 – Map of countries participating in the NTA project in 2018

The NTA consists of estimating for each moment of time and for a given economy (for now, the analysis is only made by countries) all the flows of resources that take place between the different age groups of those generations that are alive. The NTAs do not only provide profiles of consumption and labor income, but also profiles of all the variables in which they can be decomposed, as well as of the different financing mechanisms of consumption of different ages. Thus, profiles are constructed taking into account the private transfers (both inter household and intra-household), and public transfers (all taxes, social contributions and all public expenditures) by age. On the other hand, the asset-based reallocations are intertemporal since they represent resources that are accumulated in one time period (at certain age) to be used at later ages (Mason & Lee, 2011). The reallocations of assets, in the absence of appropriate statistical information required to estimate them directly, are obtained using the basic NTA equation. The NTA framework is governed by an accounting identity, which states that inflows at every age equal outflows at every age (Istenič, T., et al., 2016). All the profiles are obtained first per capita and then at the aggregate level by multiplying each profile by the population in each age group. The aggregates must match those provided by the National account of each country, so that the NTAs are consistent with the National Accounts.

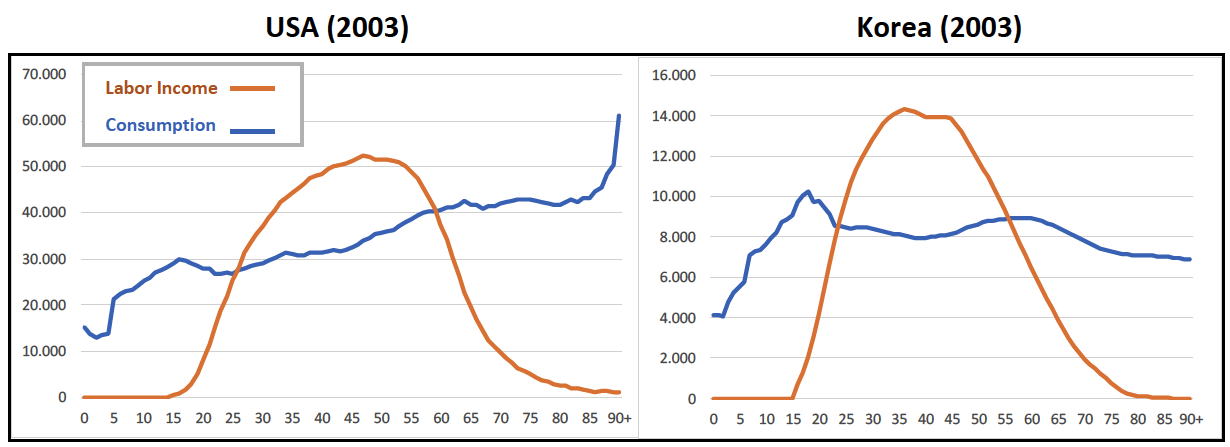

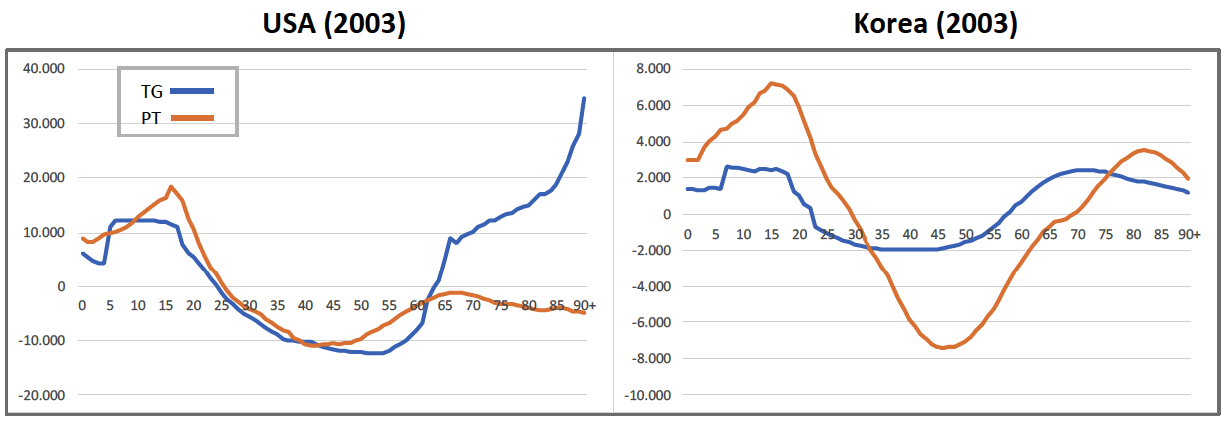

Figure 4 – Profiles by age of labor income and per capita consumption of USA and Korea, 2003 (in PPP)

In Figure 4 we show the profiles of labor income and consumption for the United States and Korea, obtained in both cases for the year 2003. As it can be seen, while labor income is clearly concentrated in active ages, consumption remains much more stable throughout life, even if there are appreciable differences between both countries. While consumption in the USA exhibits consistent growth until advanced ages, in Korea it experiences a slight decrease. The characteristics of the welfare state have a lot to do with this profile feature.

The growth of consumption at advanced ages is also observed in countries such as Sweden, Finland and Germany, and it is mainly explained by the strong public expenditure in healthcare for elderly people. On the contrary, in other European countries such as Austria, France or Spain, this growth is not observed.

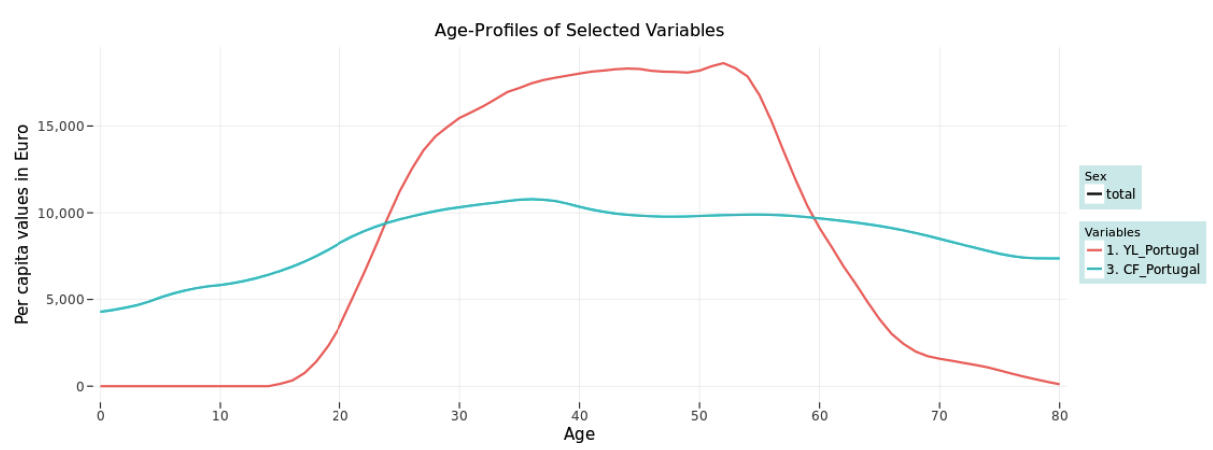

The levels of public and private transfers in the reallocation of income between generations are shown in Figure 5. In the case of the USA, children receive private transfers, but also a significant amount of public transfers, mainly in the form of educational spending and family assistance. On the other hand, in the case of the elderly, public transfers are much higher (given the weight of pensions and health), while private transfers have a negative sign, which indicates that older people transfer resources to younger people, and not the other way around. Regarding the central ages, between 22-23 years and 62-63, individuals transfer resources either to the public sector or to other members of their families. Regarding Korea, the situation is slightly different because the role of public transfers is much lower. As it can be seen, the children and the elderly receive resources from public transfers, but their magnitude is lower than those received in through private transfers within their own families.

Figure 5 – Profiles by age of net public transfers (TG) and net private transfers (PT) per capita in the USA and Korea, 2003 (in PPP)

Intergenerational transfers in Portugal

Regarding the Portuguese specific case, some previous studies already pointed to the relevance of the topic. Albuquerque (2014) measures and compares intergenerational private transfers of Portugal with other European countries (especially Southern European ones). The study indicates that Portugal shows a profile of low probability for the existence of private transfers between parents and children. The research also observes that the major deciding factor with respect to private transfers from children to parents is “need”, expressed by physical limitations and living arrangement, instead of income or wealth conditions. These results suggest, for instance, that we should not automatically link living alone with the absence of family support. Also, there is some evidence of complementarity between financial transfers and time transfers: those parents who are more likely to transfer (or receive) one form of transfer, are also more likely to transfer (or receive) the other form. Furthermore, those who receive one type of transfer are more likely to give it.

Tiefensee & Westermeier (2016) arrive to similar results. They state that, in the core European countries, the probability of receiving a wealth transfer increases with the household income. However, for Mediterranean countries, this same trend along the distribution of income is not observed. For instance, in Portugal 25% of the variation in transfers received varies independently from income. It is measured that in Portugal the share of households that received at least one wealth transfer is the lowest (27%) within European countries, while the highest shares are observed in West Germany (38%) and France (roughly 40%).

Moreover, the EU-funded AGENTA project aimed to study the means by which children and the elderly population collect resources from the working-age population. It has also relied on the methodology of the National Transfer Accounts (NTA) to develop analyses for the Portuguese case.

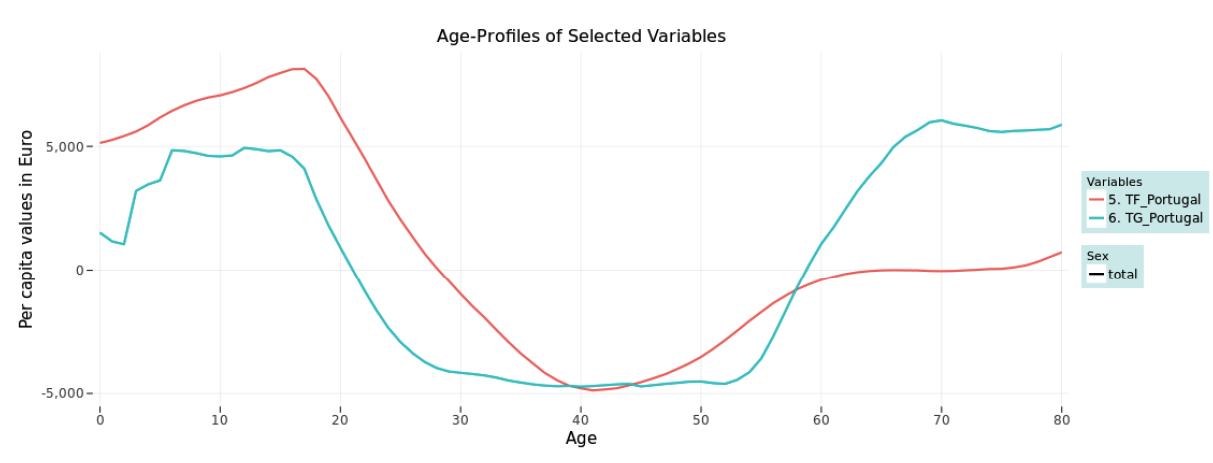

Figure 6 – Profiles by age of labor income (YL) and per capita consumption (CF) of Portugal, 2010 (in Euro)

As displayed by Figures 6 and 7, AGENTA’s estimations show trends for Portugal similar to those of USA and Korea with respect to the role of public and private transfers in the reallocation of income between generations. Regarding the profiles of labor income and consumption, the trends are more similar to the Korean case, comparing Figure 6 with Figure 4.

Figure 7 – Profiles by age of net public transfers (TG) and net private transfers (TF) per capita of Portugal, 2010 (in Euro)

Finally, Pinheiro (2018) also resorts to generational accounting and applies it for Portugal, comparing the results with those described for the Portuguese case in "Generational Accounting around the World" by Alan J. Auerbach, Laurence J. Kotlikoff, and Willi Leibfritz, published in 1999. It is observed that even though the shape of the overall generational accounts remains the same, there is an increase in the overall value of the accounts, which reflects the increase of government’s weight in the economy, but more importantly, there is a large increase of the fiscal burden for future generations.

The examples outlined here are only a sample of all the information provided by the NTA, which seems to be a very valuable tool given that it introduces the age component in the data. This allows a much more detailed analysis of how the age composition of the population and the macroeconomic variables interact.

Objective of the project

The main objective of this project is the study of transfers between generations in Portugal and their evolution during the second half of the 20th century up to the present. Intergenerational transfers occur because there are stages of life in which individuals consume more than what they produce (childhood and old age) and they need cash flows from productive age groups in order to maintain their well-being. These flows are sustained by governments (public transfers such as taxes or pensions), families (private consumption, private education, housing, etc.), or through capital markets (savings, interest payments on a loan). The distribution of resources between each stage will depend largely on political and institutional issues, but also on the changes in the demographic structure over time. For this reason, this project plans to estimate the transference profiles for different periods of life in order to analyze how their changes in time interact with demographic factors in the political and economic context. In Portugal, this type of analysis is especially interesting given the aging population, and it is possible to observe, in the long term, how different political changes influenced the distribution of resources of different age groups. From this analysis, valuable lessons can be learned to understand the determinants of the well-being of individuals, especially those dependent on other age groups. The analysis is also useful to study the sustainability of the welfare state in different economic situations and how public policies can respond to demographic challenges.

References

Abio, G., C. Patxot, E. Rentería and G. Souto (2015). “Taking care of our elderly and our children. Towards a balanced welfare state”, in M. Gas-Aixendri and R.Cavalloti, Family and Sustainable Development, Thomson Reuters, pp. 57-71.

Albertini, M. (2016). “Ageing and Family Solidarity in Europe: Patterns and Driving Factors of Intergenerational Support”. Policy Research Working Paper 7678, Poverty and Equity Global Practice Group, World Bank Group.

Albuquerque, P. C. (2014). “Intergenerational Private Transfers: Portugal in the European context”. European Journal of Ageing, 11(4), 301-312.

Altonji, J., F. Hayashi, L. Kotlikoff (1992). “Is the extended family altruistically linked? Direct tests using micro data”. American Economic Review, No. 82:1177–1198.

Auerbach, A. J., J. Braga de Macedo, J. Braz, L. J. Kotlikoff and J. Walliser (1999). “Generational accounting in Portugal”, in: Auerbach, A. J., L. J. Kotlikoff and W. Leibfritz (editors), Generational accounting around the world. The National Beareau of Economic Research.

Bloom, D.E. and J.G. Williamson (1998). “Demographic Transitions and Economic Miracles in Emerging Asia”, The World Bank Economic Review, 12(3), 340-375.

Esping-Andersen, G. (2002a). “Why we need a new Welfare State”. Oxford University Press. INE, IP. "Projecções de população residente em Portugal 2008-2060." Destaque, Lisboa-Portugal (2009).

Istenič, T., Hammer, B., Šeme, A., Lotrič Dolinar, A., & Sambt, J. (2016). “European National Transfer Accounts”. Available at: http://www.wittgensteincentre.org/ntadata.

Lee, R. and A. Mason (2011). “Population Aging and the Generational Economy. A Global Perspective”, Edward Elgar.

Mason, A. and R. Lee (2011). “Population aging and the generational economy: Key findings”, in A. Mason (Eds), Population Aging and the Generational Economy. A Global Perspective, Edward Elgar.

OECD (2014). “Society at a Glance 2014: OECD Social Indicators”, OECD Publishing. http://dx.doi.org/10.1787/soc_glance-2014-en.

Patxot, C., E. Rentería and G. Souto (2015). “Can we keep the pre-crisis living standards? An analysis based on NTA profiles in Spain”, Journal of Economics of Ageing, 5, pp. 54-62.

Patxot, C., E. Rentería, M. Sánchez-Romero and G. Souto (2011). “How intergenerational transfers finance the lifecycle deficit in Spain”, in R. Lee and A. Mason, Population Aging and the Generational Economy. A Global Perspective, Edward Elgar, p.241-255.

Patxot, C., E. Rentería, M. Sánchez-Romero and G. Souto (2012). “Measuring the balance of government intervention on forward and backward family transfers using NTA estimates: the modified Lee arrows”, International Tax and Public Finance, 19, p. 442-461.

Pinheiro, J. (2018). “Generational Accounting for Portugal”. (Unpublished master dissertation). Universidade Católica Portuguesa, Lisbon, Portugal.

Rentería, E., G. Souto, I. Mejía-Guevara and C. Patxot (2016). “The effects of education on the demographic dividend”, Population and Development Review, 42 (4), p. 651-671.

Sánchez-Romero, M., G. Abio, C. Patxot, G. Souto (2018). “Contribution of Demography to Economic Growth”, SERIEs Journal 9, pp. 29-64.

Tiefensee, A., & Westermeier, C. (2016). Intergenerational transfers and wealth in the Euro- area: The relevance of inheritances and gifts in absolute and relative terms.

UN (2013). National Transfer Accounts Manual. Measuring and Analysing the Generational Economy. Population Division, Department of Economic and Social Affairs, United Nations, New York.